Major Shake-Up for Domestic Building Contracts in Victoria

For many families, their home is the single biggest investment of their lives. As Consumer Affairs Minister Nick Staikos noted in the second reading speech introducing the reforms, a home is “the foundation of their future,” which makes it essential that Victoria’s laws around domestic building contracts are “clear, effective and modernised” to protect consumers. […]

Rosh Hashana: A Season of Reflection and Renewal

As the Jewish High Holy Days approach, the team at Warlows Legal extends our warmest wishes to our clients, colleagues, and community. This period is one of the most meaningful times in the Jewish calendar, filled with opportunities for reflection, renewal, and connection. Rosh Hashana, the Jewish New Year, marks a moment to pause and […]

Conveyancer or Solicitor? Understanding the Differences in Conveyancing Matters

Buying or selling property is one of the most significant financial decisions we make. One of the most important steps in that process is conveyancing. In Australia, both conveyancers and solicitors can handle conveyancing work. However, while they perform similar tasks, there are differences between the two that are important to understand before deciding who […]

What is an ABN and Do You Need One?

Starting a business in Australia can feel like stepping into a world of acronyms – GST, BAS, ACN, TFN. But one of the most important of them all is the ABN, or Australian Business Number. Behind those 11 digits lies the foundation of how your business is identified, taxed, and recognised by both the government […]

What should you expect from your lawyer under the new AML laws?

Overview The Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 (Cth) was passed by Parliament in November 2024. It updates the existing AML/CTF Act 2006 to strengthen Australia’s ability to prevent and respond to money laundering and terrorism financing, and to align with international standards set by the Financial Action Task Force (FATF). From 1 […]

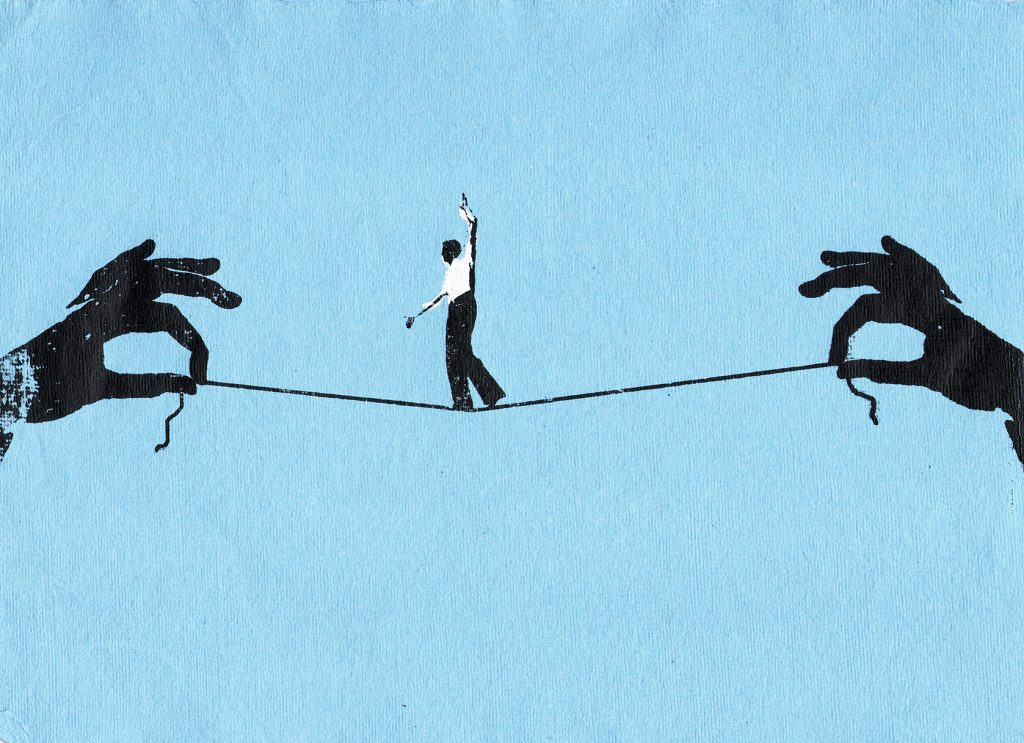

Understanding Whistleblowing in Australia’s Legal Landscape

Speaking up should be simple. In a just system, exposing misconduct or abuse of power ought to be encouraged – not punished. Yet for many whistleblowers, doing the right thing can quickly become a stressful, risky, and costly ordeal. What is Whistleblowing? Whistleblowing refers to a person who reports an individual or organisation engaged in […]

Can a Solicitor Also Be a Litigation Guardian? Exploring the Exception to the Rule in Victoria

In Victoria, the general rule is that a litigation guardian must act through a separate solicitor, to avoid any conflict of interest. However, in limited cases, such as where it’s cost-effective or no one else is available, the court may allow the same person to act as both solicitor and litigation guardian, provided there’s no […]

Don’t Get Caught Out: Common ACNC Compliance Mistakes (and How to Avoid Them)

For many small charities in Australia, compliance with regulatory obligations can feel like an overwhelming burden. Between chasing funding, managing volunteers, and delivering community programs, administration and record-keeping can easily slip down the priority list. But failing to comply with ACNC requirements can lead to serious consequences, including loss of registration, reputational damage, and even […]

Owners Corporation Disputes in Victoria: A Reconfigured Jurisdiction

Over the past year, a series of Magistrates’ Court decisions has upended common practice in owners corporation levy recovery. These rulings confirm that such disputes must now be brought exclusively in VCAT, reshaping the jurisdictional landscape in Victoria. Background Over the past twelve months, a sequence of significant decisions[1] rendered by the Magistrates’ Court of […]

When Construction Goes Wrong, Insurance Can Step In

Building a home is meant to be one of the most rewarding experiences of your life. It’s where savings, ideas, and emotions come together to create something meaningful – a place to live, grow, and feel safe. But sometimes, the process doesn’t go to plan. Defective work, delays, or even a builder who walks off […]